Originally posted by Moliere

View Post

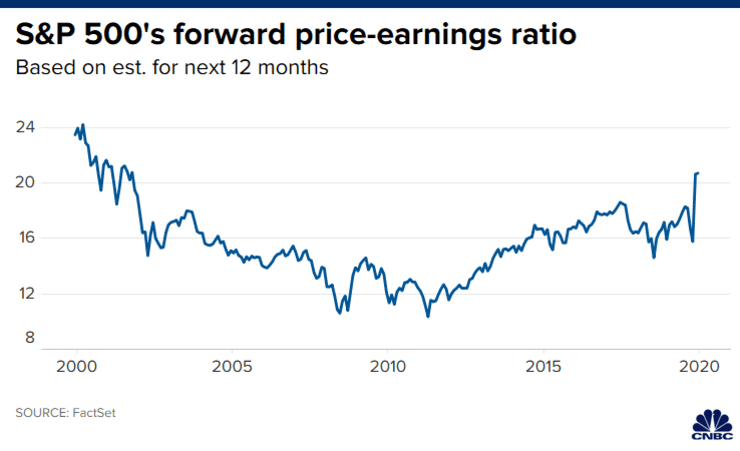

Regardless, the GDP report was backward looking and the market is forward looking.

Comment